The Defy Aging Newsletter

Anti-aging psychology, holistic health, and wellness

These are archives of a biweekly e-mail newsletter for helping you think, feel, look, and be more youthful and live with purpose.

June 21, 2007 Number 167

This issue:

Longevity Insurance

Action to take

Consider longevity insurance.

Why

Only a third of Americans say they would like to live to 100. Reasons include fearing they will run out of money and be poor.

In a previous newsletter I cited a British man who bet $200 he would live to 100 and eventually received $50,000 for winning his bet. Since then the odds makers want to increase the target to 110 years old.

But there is a relatively new way to win that kind of bet longevity insurance.

Personally, I really dislike life insurance as I hate betting against myself. You (or rather your survivors) only get the money if you die. Longevity insurance rewards you for living longer and helps make sure you have enough income starting at age 85. For example, let’s say a 65-year-old man pays $50,000 in after tax money for a longevity policy. At age 85 he starts collecting $3,614 a month ($43,368 a year) for the rest of his life. If he dies before age 85 he and his heirs receive nothing. For women, the monthly payments would be somewhat lower because of a longer life expectancy. Of course you can purchase the insurance before age 65 and receive even higher monthly premiums at 85.

At age 65, life expectancy for American men (2004 data) was 82.1 years and women 85 years. Met Life, Hartford, and other insurance companies are betting that in most cases they won’t have to pay anything.

You could take the same money and invest it in stocks or bonds. That would allow you to take money out in an emergency and to pass on money to heirs. If you get a 6% after tax return rate on your investments compounded over 20 years, you would start coming out ahead a shortly before your 90th birthday with the longevity insurance.

The primary advantage of the insurance is less concern about outliving your money. It also might be out of reach in the event of a lawsuit or divorce. Unlike life insurance, you don’t need to qualify, you only need a birth certificate.

The biggest risk with longevity insurance is not living to 85 and collecting nothing. Another risk is the insurance company could go out of business.

Another consideration is the likelihood of inflation. Whether you invest the money in an IRA or have longevity insurance, the money will probably have far less purchasing power in 20 years. At 4% inflation compounded annually, $1,000 in today’s money would be worth $456 in 20 years. In our previous example the monthly payment would be equivalent to $1,648 in today’s dollars and each year the value would be a little less.

With life expectancies likely to increase, purchasing longevity insurance in the future is likely to bring lower monthly benefits than are being offered now. If you believe you have a good shot at living to 100 or older, longevity insurance can be a good bet.

Quotes

Corporations often purchase “key man” insurance on staff they can’t afford to lose. Think of yourself as the key man or woman in the business of your own life. But rather than buy life insurance, do what it takes to live longer and healthier.

~Mike Brickey

Humor

My wife and I took out life insurance policies on each other, so now it’s just a waiting game.

~Bill Dwyer

The insurance man told me that the accident policy covered falling off the roof, but not hitting the ground.

~Tommy Cooper

Can atheists get insurance for acts of God?

Reprint this article from:

THE DEFY AGING NEWSLETTER

Anti-Aging Psychology

Holistic Health and Wellness

This newsletter article may be reprinted in E-zines, newsletters, newspapers, and magazines provided the content is not edited and the attribution below is given. Formatting may be changed and you may use one of the web site pictures of the author to accompany the article.

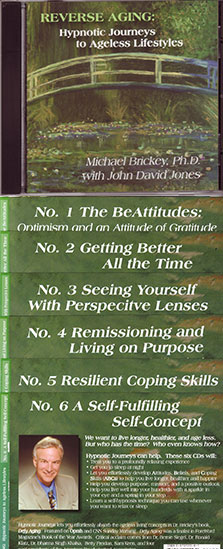

"Dr. Michael Brickey, The Anti-Aging Psychologist, teaches people to think, feel, look and be more youthful. He is an inspiring keynote speaker and Oprah-featured author. His works include: Defy Aging, 52 baby steps to Grow Young, and Reverse Aging (anti-aging hypnosis CDs). Visit www.NotAging.com for a free report on anti-aging secrets and a free newsletter with practical anti-aging tips."